Following on to the MAS’ decision to repeal the RFMC regime in the middle of 2024, it is crucial for Registered Fund Management Companies (RFMC) to take note of the specific timelines and criteria provided by the Monetary Authority of Singapore for the transition of RFMCs to Accredited/Institutional-Investor Licensed Fund Management Companies (A/I LFMCS).

Main factors for consideration:

MAS will approve an RFMC’s application to be an A/I LFMC if the RFMC:

(a) has managed third-party assets in the six months immediately prior to the submission of Form 1AR to MAS. RFMCs need to be able to demonstrate such third-party asset management in substance, and the MAS may require documentation justifying the same;

(b) submits the Form 1AR within the stipulated timeline (i.e. by 30th June 2024) ; and

(c) upon further queries from MAS, provides the requisite documentation and information to the MAS’ satisfaction (which may include documentation as highlighted in (a) above)

Communication with Investors

It is essential that RFMCs continue to prioritise the interests of their investors and maintain transparency in their operations. RFMCs may consider informing their investors and keeping them in abreast of the development relating to the current transition and how it may affect them and the business.

It is important to note that RFMCs that are unable to secure an A/I LFMC license before the repeal date of 1st August 2024 will lose their regulatory status to conduct fund management activities.

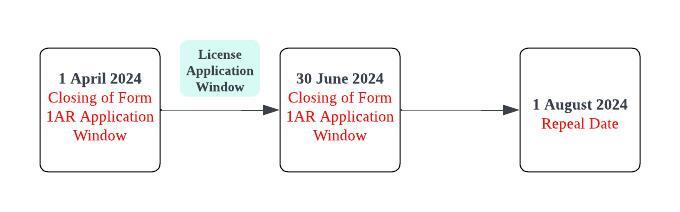

| Key Matters | Timelines |

| RFMC Repeal Date | 1st August 2024 |

| License Application Window (submission of Form 1AR) | 1st April 2024 – 30th June 2024 |

| Successful License Applications | Informed within the week of 29th July |

| All Notification for Change of Particulars of Representatives via Form 23A pertaining to RFMCs | Submitted by 15th July 2024 |

| Quarterly Returns Requirement | Starts from the next calendar quarter ending – 30th September 2024 |

Additional Administrative Timelines

| MASNET accounts assigned under the RFMC must be arranged/cleaned up (removal of any outdated accounts) | By 30th June 2024 |

Timelines for the targeted RFMC Repeal date, license application window and notification of successful license applications:

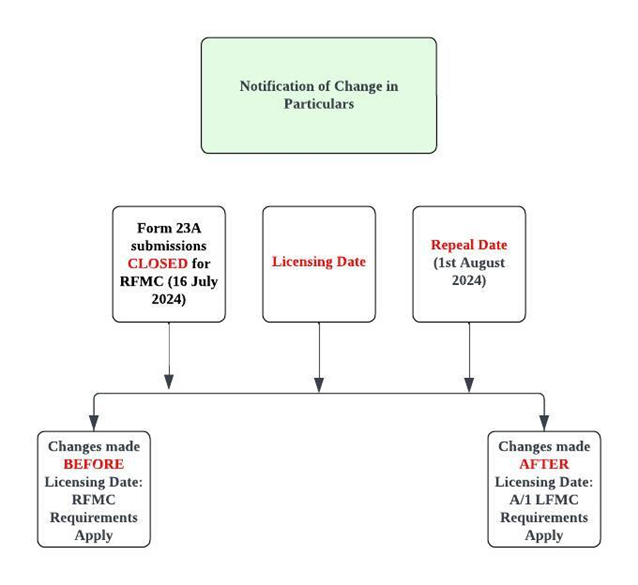

Changes in Particulars Before and After Transition

An RFMC needs to ensure that all Changes in its Particulars are made via Form 23A by the 15th of July 2024. The Corporate E-Lodgement portal (CeL) will no longer be accepting Form 23A submissions after this date. For changes made before the licensing date, an RFMC must notify MAS within 14 days of the change even if it extends past the Repeal Date. A/I LFMC requirements will apply if any changes are made after the Licensing Date

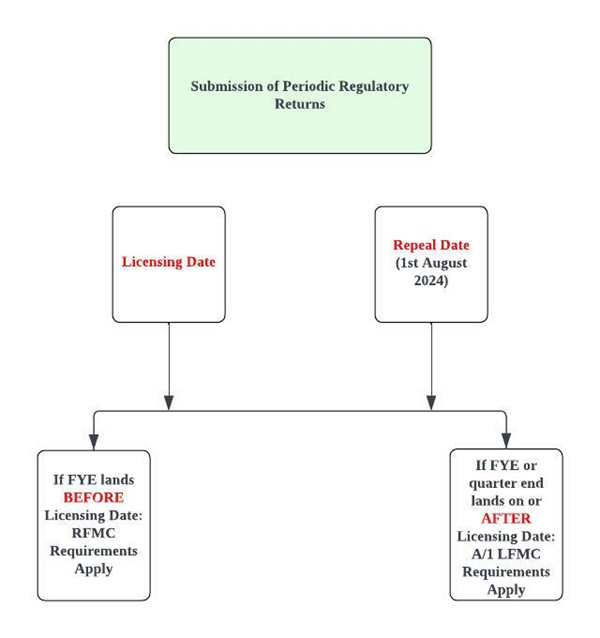

Submission of Regulatory Returns

RFMCs with a financial year end (FYE) before the licensing date should still follow the RFMC requirements of submitting Form 25A within one month of the FYE and Form 25B within 5 months of the FYE even if it extends past the repeal date.

From the licensing date, these forms should be emailed to the respective MAS Officer In Charge. There is no requirement for a RFMC to then submit Forms 1-6 following the A/I LFMC’s requirements for the same financial year.

However, if an RFMC’s FYE or quarter end lands on or after the licensing date, A/I LFMC requirements will apply.

How Can We Help?

Our dedicated team based in Singapore is instrumental in guiding organizations through the transition from RFMCs to A/I LFMCs. We can assist you with the transition, as well as support you with the additional regulatory requirements that you would be required to comply with as an A/I LFMC.

We offer comprehensive regulatory compliance support, along with tailored assistance in crafting policies and procedures, providing ongoing compliance support and conducting regular internal audits to align your business model and regulatory requirements with that of the MAS, while ensuring that you are always commercially sound.

If you are unfamiliar with the A/I LFMC requirements, we can assist to ensure that your business continues to run efficiently and seamlessly through this transition.

The support and services we can provide include:

- Assisting with the transition process.

- Reviewing and upgrading of compliance manuals to fit the current A/I LFMC requirements.

- Training of personnel to be kept abreast of A/I LFMC requirements.

- Assisting to prepare and review regulatory submissions (i.e quarterly returns submissions)

- Ongoing regulatory support upon obtaining the A/I LFMC status.

- Internal Audits (as mandatory for all A/I LFMCs)

Reach out to us today at Admin@thecuriaregis.com to discover how we can help you face such a transition, or if you’d like to like to understand how you will be impacted by this change.

References

- FREQUENTLY ASKED QUESTIONS ON REPEAL OF THE REGULATORY REGIME FOR REGISTERED FUND MANAGEMENT COMPANIES, MONETARY AUTHORITY OF SINGAPORE : https://www.mas.gov.sg/-/media/mas-media-library/publications/consultations/cmi/2024/faqs–repeal-of-rfmc-regime-25-apr-2024.pdf